- Professional Risk Insurance

- Private Clients

- Farms & Estates

- Commercial Clients

- Wholesale Insurance Broking

- Claims

- About

- Contact

- Log in

Log in

Commercial Clients

Commercial Combined

Commercial Combined Insurance is a comprehensive insurance solution designed to protect businesses in the UK from a wide range of risks and liabilities.

Commercial Combined Insurance

Commercial Combined Insurance is a comprehensive insurance solution designed to protect businesses in the UK from a wide range of risks and liabilities. This type of insurance is essential for businesses of all sizes and sectors, as it provides a versatile and adaptable way to safeguard your operations, assets, and financial well-being.

Here are some key points to consider when reviewing your Commercial Combined Insurance:

- Comprehensive Protection: Commercial Combined Insurance offers a versatile blend of coverages that can be customised to suit your specific business needs. This may include coverage for property, liability, business interruption cover, contents, employer’s liability, public liability, personal accident cover, money and more. It’s a one-stop solution to protect your business against a multitude of risks.

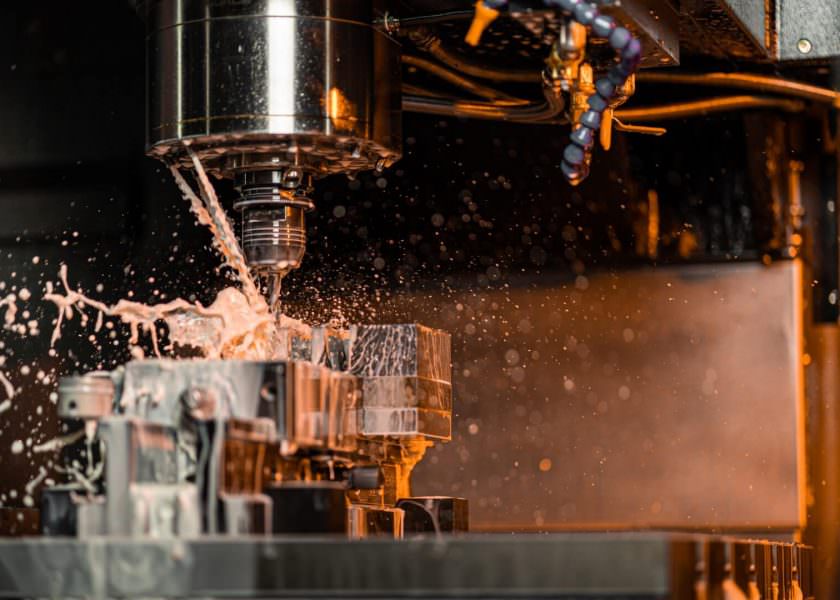

- Tailored to Your Business: One of the most significant advantages of Commercial Combined Insurance is its flexibility. You can tailor the policy to match the unique characteristics of your business, whether you run an office, a manufacturing facility, a retail store, or any other type of operation.

- Cost-Efficiency: By bundling various coverages into a single policy, you can often reduce your insurance costs. This not only simplifies your insurance portfolio but can also result in cost savings for your business.

- Protection Against a Possible Eventuality: Commercial Combined Insurance protects your business from financial losses and unexpected costs in the event of an unforeseen risk events occurring. Risks include fire, theft, vandalism, damage to equipment, public and employers’ liability, and more. Insurance can ensure that your business remains resilient in the face of unexpected challenges.

- Business Continuity: In the event of a disaster or unforeseen event that disrupts your business operations, Commercial Combined Insurance can provide coverage for business interruption. This helps you maintain cash flow and recover more quickly.

- Legal Compliance: Certain aspects of this insurance, like employers’ liability, are often legally required in the UK. Compliance with such regulations is crucial to avoid fines and legal complications.

- Professional Advice: When considering Commercial Combined Insurance, it’s essential to consult with a reputable insurance broker who can assess your unique risks and guide you through the selection process. A broker can help you make informed decisions and ensure that your coverage is tailored to your specific needs.

- Peace of Mind: Ultimately, Commercial Combined Insurance offers peace of mind, knowing that your business is protected against a wide range of risks, allowing you to focus on growing and running your business without the constant worry of unexpected financial setbacks.

Commercial Combined Insurance or Business Insurance – what’s best for your business – read our article here

See also

Business Insurance

Retail/Shop Insurance

Manufacturing