- Professional Risk Insurance

- Private Clients

- Farms & Estates

- Commercial Clients

- Wholesale Insurance Broking

- Claims

- About

- Contact

- Log in

Log in

Commercial Clients

Business Insurance

Business Insurance is a comprehensive insurance solution designed to protect businesses in the UK from a wide range of risks and liabilities.

Protecting Your Business: Understanding Business Insurance

Running a successful business involves juggling various responsibilities, and one crucial aspect that should never be overlooked is insurance. Business Insurance is a comprehensive solution designed to safeguard your business premises, assets, and operations. In today’s dynamic business landscape, having the right insurance coverage is not just a prudent decision; it’s a necessity.

It’s important to note that Business Insurance is a very generic term and, in fact your insurance policy should be tailored to your specific sector. An online retailor will require different cover than say a tradesman or law firm. It would be most advantageous and cost-effected if your policy provided cover for areas that are important to your business activities rather than a one-size-fits-all approach. Having said that, here we detail what Business Insurance can cover and the invaluable benefits it provides.

Coverage Overview

- Property Protection: Business Insurance typically covers the physical structure of your business premises, including the building itself and its contents. This encompasses office furniture, equipment, computers, and other valuable assets. In the unfortunate event of fire, theft, or natural disasters, this coverage ensures that the financial impact on your business is mitigated.

- Liability Coverage: Businesses are exposed to various liabilities, and Business Insurance helps shield you from the financial repercussions of third-party claims. Whether it’s a customer slipping and falling on your premises or damage caused by your employees during work-related activities, liability coverage is a vital component.

- Business Interruption: Imagine your office being temporarily unusable due to unforeseen circumstances. Business Interruption coverage steps in to compensate for the lost income during the downtime, ensuring that your business can weather the storm and resume operations smoothly.

- Legal Expenses: Dealing with legal matters can be costly. Business Insurance often includes coverage for legal expenses, providing financial support in situations where your business needs to defend itself or pursue legal action.

- Cyber Liability: As businesses increasingly rely on digital operations, the risk of cyber threats grows. Business Insurance can include Cyber Liability coverage, protecting your business against the financial fallout of data breaches, hacking, and other cyber incidents. Depending on your specific need and the nature of your business you may require a higher level of cover with an independent cyber policy.

Benefits of Business Insurance

- 1. Financial Security: One of the primary benefits of Business Insurance is the financial security it provides. In the face of unexpected events, having insurance coverage ensures that your business can recover without bearing the full brunt of the financial burden.

- 2. Business Continuity: Business interruptions can be disruptive, but with the right coverage, you can maintain business continuity. Whether it’s replacing damaged equipment or covering ongoing expenses during downtime, Business Insurance plays a crucial role in keeping your business afloat.

- 3. Peace of Mind: Knowing that your business is protected against a range of risks brings peace of mind. This allows you to focus on your core operations and strategic growth, rather than worrying about potential financial setbacks.

- 4. Compliance and Assurance: In many cases, having certain insurance coverages is a legal requirement. By investing in Business Insurance, you not only fulfil your legal obligations but also assure your clients, partners, and stakeholders that your business is well-prepared for unforeseen events.

In conclusion, Business Insurance is a comprehensive and essential tool for safeguarding your business. From protecting physical assets to providing financial support during challenging times, the benefits of having the right insurance coverage are invaluable. As a specialist, independent insurance broker, Cox Mahon understands the unique needs of businesses in this region and can tailor Business Insurance solutions to suit your specific requirements. Don’t leave your business exposed – invest in Office Insurance today for a more secure and resilient tomorrow.

Q&As

Q1. What is Business Insurance, and why is it essential?

Business Insurance is a comprehensive coverage plan designed to protect businesses from various risks associated with operating in an office environment. This insurance provides financial security in the face of unforeseen events, ensuring the continuity of business operations.

Q2. What does Business Insurance typically cover?

Business Insurance typically covers property damage, business interruption, liability claims, and employee-related risks. It safeguards against perils such as fire, theft, natural disasters, and other incidents that could disrupt normal business operations.

Q3. How does Business Insurance protect against property damage?

Business Insurance protects against property damage by covering the repair or replacement costs of office buildings, equipment, and other assets in case of damage or destruction due to covered perils.

Q4. Can Business Insurance help with business interruption?

Yes, Business Insurance can include coverage for business interruption, compensating businesses for lost income during downtime caused by covered events. This ensures financial stability during the recovery period.

Q5. Does Business Insurance cover liability claims?

Yes, Business Insurance includes liability coverage, protecting businesses from legal expenses and damages associated with third-party injury or property damage claims that may arise within the office premises.

Q6. How does Business Insurance address employee-related risks?

Business Insurance may include coverage for employee-related risks, such as injuries sustained on the job. This coverage helps manage medical expenses and potential legal claims from employees.

Q7. Are home offices covered under Business Insurance for remote workers?

While some policies may offer limited coverage for home offices, it’s crucial to discuss specific requirements with an experienced and competent insurance provider. Additional coverage may be necessary for comprehensive protection for remote workspaces.

Q8. How can businesses determine the right coverage limits for their Business Insurance?

Determining the right coverage limits involves assessing the value of office assets, potential income loss, and the specific risks associated with the business. Consulting with an experienced insurance broker, Cox Mahon can help tailor coverage to the unique needs of your business.

Q9. Are there any discounts or incentives for implementing risk management practices?

Some insurers may offer discounts for businesses implementing risk management practices, such as security measures and safety protocols. Engaging in proactive risk mitigation can lead to more favourable insurance terms.

Q10. How often should businesses review and update their insurance policies?

It’s advisable for businesses to review and update their insurance policies annually or whenever there are significant changes in the business structure, assets, or operations. Regular reviews ensure that coverage remains aligned with the evolving needs of the business.

Business Insurance or Commercial Combined Insurance – what’s best for your business – read our article here

See also

Commercial Combined

Retail/Shop Insurance

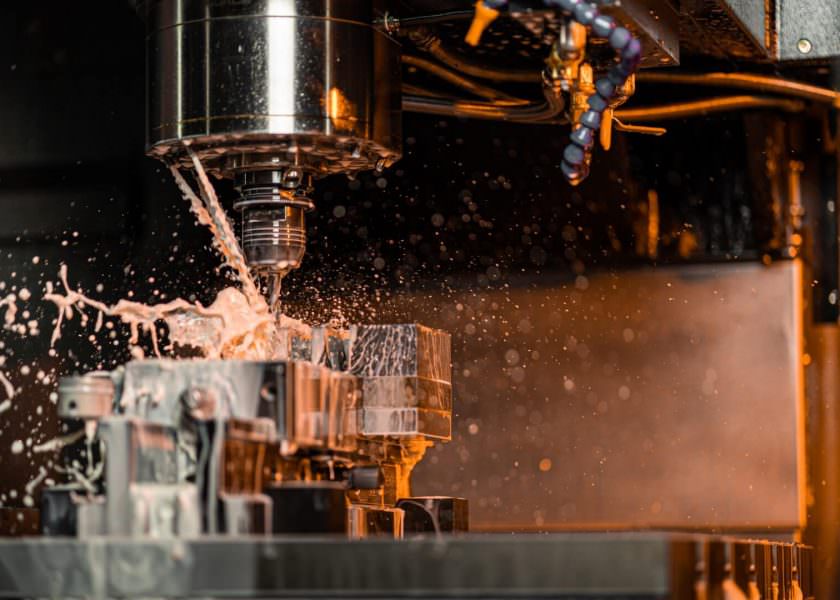

Manufacturing